A Crypto War in Ukraine?

Introduction

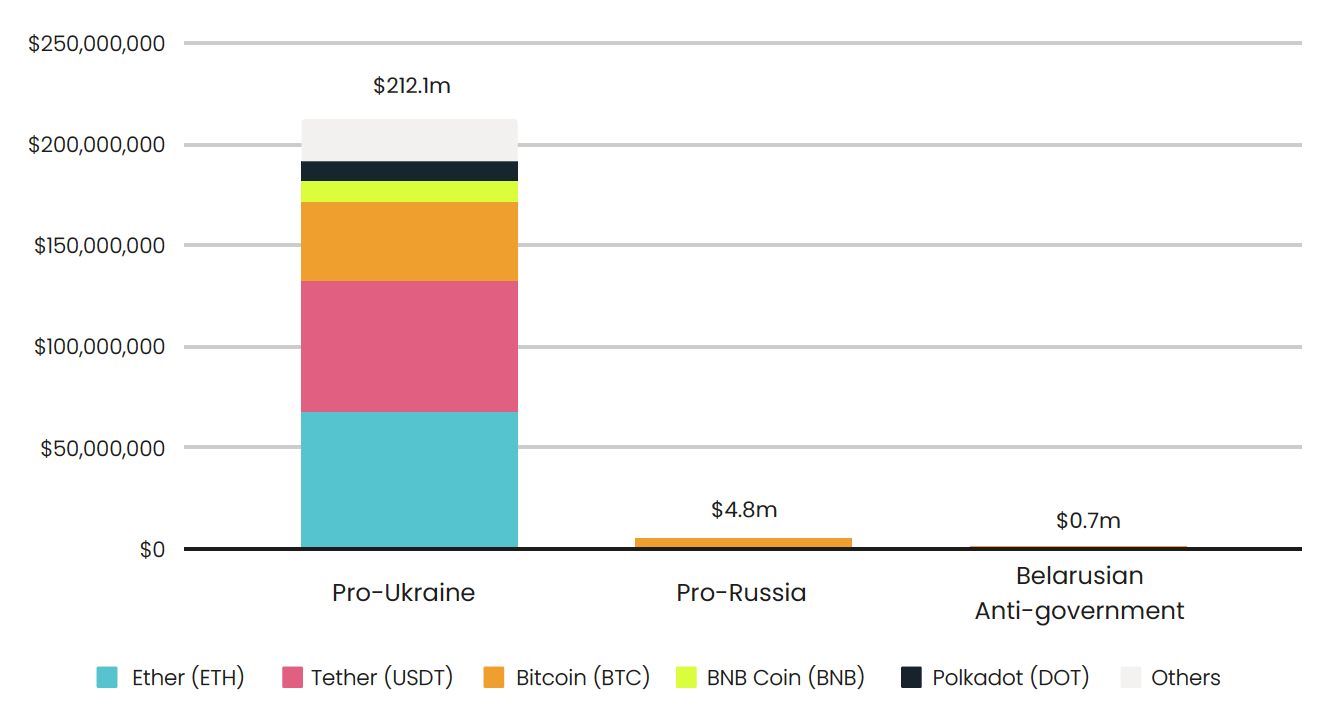

The Russian invasion of Ukraine has been one of the most significant geopolitical events in recent years. The conflict has had far-reaching consequences, and its impact can be felt not just in Ukraine but around the world. One aspect of the conflict that has received increasing attention in recent months is the role of cryptoassets in the hostilities. Only considering the role of crypto in the funding drive, Pro-Ukrainian causes are reported to have raised over $212 million in cryptoassets, which is one fifth of the total non-state aid funds obtained, while pro-Russian entities have raised a smaller amount of $4.8 million, with possibly over 10% of these funds originating from illicit sources. In this article, we will explore the role of crypto in the Russian invasion of Ukraine.

Blockchains at war

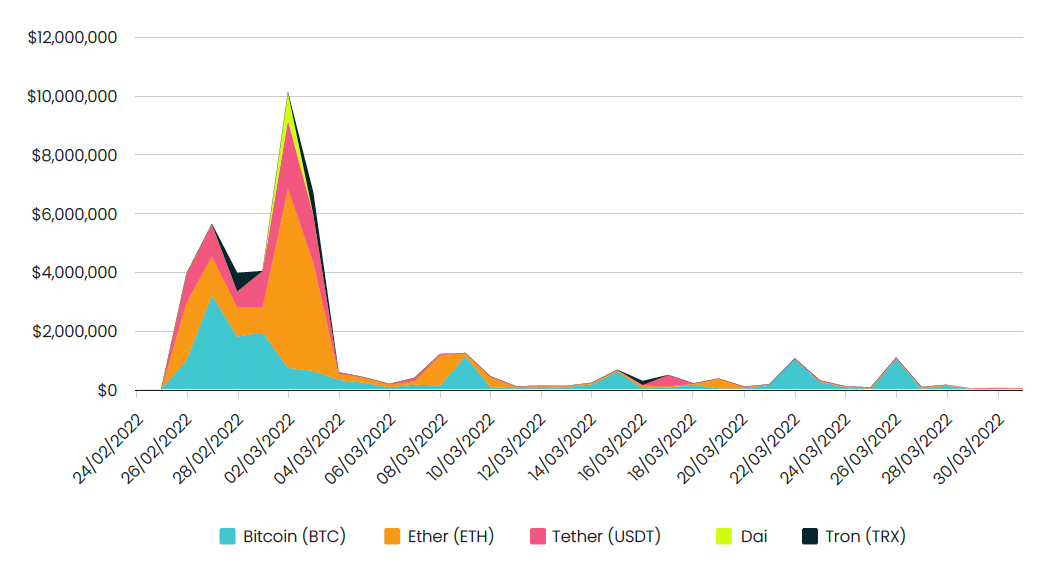

Two days after the start of the Russian invasion, on February 26th, the official Ukrainian Twitter page published Bitcoin and Ethereum addresses for donations. This was possibly one of the most significant endorsements and adoptions of cryptoassets by a national government, second only to El Salvador's declaration of Bitcoin as legal tender in September 2021.

At the same time, for the first time, crypto has appeared in the packages of sanctions enacted by the West in response to the Russian invasion. For example, the 8th round of sanctions by the European Union has enacted a full crypto ban on Russia, tightening the previously declared 10,000 euros restriction on transactions.

The role of cryptoassets in the conflict is potentially multifaceted. Policy discussions and reports have highlighted several aspects:

- Financing the war: Cryptoassets have been used to raise funds by both government organisations and militant groups. Criminals and scammers have been also tried to profit from the goodwill of the public towards Ukraine.

- Financing militant groups: Pro-Russian separatist organisations and agents have been reported to have received funds from Moscow via crypto transfers.

- Sanctions avoidance: Cryptocurrencies have been used in the past to move money across borders, bypassing international sanctions and restrictions on traditional financial systems.

- Ransomware and crypto attacks: Pro-Russian groups have been targeting countries that support Ukraine, as well as organisation that raise funds through cryptoasset donations, sometimes diverting funds to Russia.

Let’s have a look at what has happened.

Financing the war and the humanitarian response

Ukraine has been a trailblazer in crypto. In September 2020, its parliament passed a law called "On Virtual Assets" that provided a legal framework for the use and regulation of cryptoassets, which has helped to promote their adoption and use in the country. This framework was leveraged right at the start of the conflict when Ukraine tried to finance Its efforts by using cryptoasset donations.

But how big has been the role of crypto in rising funds? Elliptic, a London-based blockchain analysis provider, conducted detailed analysis of over $230 million worth of blockchain activity to understand the use of cryptoassets by both Ukraine and Russia in their fundraising campaigns to sustain their war efforts.

Figure 1 – Cryptoassets received by pro-Ukrainian, pro-Russian and Belarusian anti-government wallets

The report has found that pro-Ukrainian causes raised over $212.1 million in cryptoassets, with most of it going to official Ukrainian government wallets (Figure 1). On the other hand, pro-Russian entities raised only $4.8 million in crypto donations, and some attempts to emulate Ukraine's success with NFTs and DeFi failed.

While the pro-Russian funding has been almost exclusively in Bitcoin, the most widely traded cryptoasset by market capitalisation, one noticeable trend that has emerged in pro-Ukrainian fundraisers is their reduced reliance on Bitcoin (Figure 1). The reason for that is that Ukraine has tried to leverage on the tech potential of crypto, while Bitcoin does not support web3-based innovations like DeFi, NFTs, and DAOs that are more prevalent on blockchains such as Ethereum (the second largest by market cap). By utilising the opportunities presented by web3, fundraisers have been able to launch successful DeFi-powered donation campaigns.1

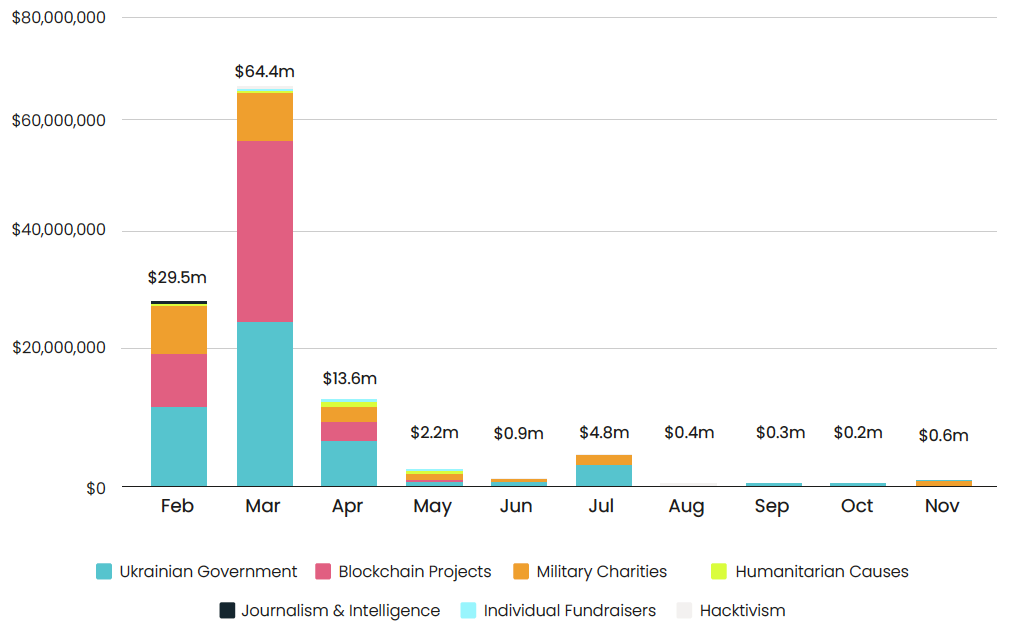

Figure 2 – 2022 BTC and ECH monthly flows into pro-Ukrainian wallets

The invasion happened at the peak of the NFT wave, and NFTs represented an important part of the donations. The Ukrainian government created an ETH donation address for NFTs in April 2022, and an online NFT gallery was launched at the same time. The government received 1,000 NFTs, yet many of them were scams or spam NFTs and were delisted by Opensea. The most valuable NFT donated was a CryptoPunk worth $133,500, followed by an NFT worth just under $10,000. NFT donations slowed down in mid-May, and the CryptoPunk was sold for $115,000 on June 19th. Overall, Ukraine received $190,000 worth of Ethereum-based NFTs through donations.3

Looking at the structure of the campaign, on the pro-Ukrainian side, the largest initiative is the government led “Aid For Ukraine” campaign, which was launched on the 26th of February and accepts donations in a number of cryptocurrencies, including Bitcoin and Ethereum.2 Overall, the campaign raised over $83 million, making it a staggering success. This highlights the potential of the technology. Several other government organisations and independent charities organised funding campaigns also accepting cryptoassets, including the security services of Ukraine, the Ministry of Health, the Azov unit and several other regiments, a few cyber intelligence organisations, as well as many charities and humanitarian organisations.

The funding dynamics have been very much frontloaded. The invasion led to an immediate surge of funding. Most donations to Ukraine occurred in February and March 2022, just after the full-scale invasion began, with over 80% of the donations taking place during this period. In November 2022, the most popular pro-Ukrainian donation wallets received nearly $0.6 million in BTC and ETH.

Figure 3 – Daily donations to “Aid for Ukraine”

As of November 2022, the National Bank special account in Ukraine had received $606.7 million in donations, while United24 received $232.8 million, some of which was through cryptoassets. Excluding United24 and Monero, pro-Ukrainian crypto donations accounted for just over a fifth of the roughly $1.05 billion raised by these three major donation campaigns. While this is a minority share, it is significant as the conflict between Ukraine and Russia marks the first time that crypto has played such a significant role in a conflict.

While Russian officials have suggested accepting Bitcoin for oil and gas exports, the country's crypto-averse stance and the lack of sympathy across the world has contributed to the limited use of cryptoassets to finance the invasion. The majority of the identified $4.8 million in crypto raised has been donated to military fundraisers. Several regiments, private mercenary groups or individual fighters have used social media as their own propaganda channels asking for donations.

The financing of militant groups and militias

There is evidence to suggest that Russia has used cryptocurrencies to finance the separatists in eastern Ukraine, and long before the full invasion. A report by the U.S. Department of the Treasury in 2018 found that the Russian intelligence agency GRU had used cryptoassets to fund its operations in Ukraine. The report stated that the GRU had used cryptoassets such as Bitcoin to pay for the registration of fake social media accounts, which were used to disseminate propaganda and disinformation about the conflict.

Cryptoassets are a convenient way for a state conducting covert operations to send money to separatists without being detected. Unlike traditional banking transactions, which can be traced and monitored, cryptoasset transactions are anonymous and difficult to track. This makes them ideal for illicit activities such as funding armed groups.

Russian forces have attempted to gather information on Ukrainian positions by leveraging social media and offering cryptoasset rewards. A Telegram bot, purporting to be a legitimate source from the Donetsk People's Republic People's Militia, has also been used to collect intelligence by offering Bitcoin incentives. This bot has been promoted by Daniil Bezsonov, the Deputy Information Minister of the DPR.

More gruesome and criminal use of cryptoassets has also appeared. The mercenary “Task Force Rusich” has raised over $105,000 in cryptoasset donations and has advertised a particularly brutal use for cryptoassets on its Telegram channels: “If you can identify the bodies of those killed, don’t just give them away. Take the coordinates of the exact burial place […] and offer relatives the details for $2,000-$5,000. Money can be transferred to your Bitcoin wallet.”

Financing dissident groups

While cryptoassets can be used for criminal purposes, it has also emerged as a potential lifeline to the political opposition and dissidents in Russia and Belarus. Indeed, cryptoassets have emerged as a viable way for these groups to fundraise and operate anonymously, outside centralised government oversight. Major opposition figures, such as Alexei Navalny, have accepted crypto donations for their political campaigns, with donations surging since the start of the Russian invasion in March 2022.

In Belarus, the use of cryptoassets by opposition groups has also risen sharply, particularly in response to the controversial presidential election in 2021, which led to protests and government crackdowns. Dissident entities fundraising in cryptoassets range from charities providing financial support to families affected by political imprisonment to hacktivist groups that target government infrastructure. One example of the former is the Belarusian Solidarity Foundation (BYSOL), which has received over $315,000 in crypto donations, while one of the most visible examples of the latter is "Superativ," an umbrella group of three organisations that has engaged in both cyber and physical attacks throughout Belarus and is banned by the Belarusian government.

Avoiding sanctions

Concerns have been raised about the potential for Russia to use cryptoassets to evade sanctions. While cryptoasset transactions are publicly viewable on blockchains, some individuals may attempt to obscure their transactions through practices such as chain-hopping, mixers and tumbling services, unhosted wallets, anonymity-enhanced cryptoassets, and peer-to-peer exchanges. While not all these practices are illegal or used uniquely for sanctions evasion, they may be used to hide illicit funds.

Overall, the consensus is that cryptoasset markets are likely too illiquid to support mass Russian sanctions evasion. However, there may still be smaller-scale activity occurring (Congressional research services, “Russian Sanctions and Cryptocurrency"). The US Financial Crimes Enforcement Network (FinCEN) has stated that while it is possible for sanctioned individuals and institutions to try to use cryptoassets for sanctions evasion, large-scale evasion by a government such as Russia is not necessarily practicable. This assessment has been echoed by Secretary of the Treasury Janet Yellen at a recent congressional hearing.

Despite a small spike in inflows to these exchanges around the time of the invasion in February 2022, this may have been motivated by a desire of the broader population to protect their savings by converting from the Ruble rather than to evade sanctions.

While it is true that capacity and liquidity constraints and sanction enforcement by exchanges may make wholesale sanction evasion using cryptoassets less feasible, it is also true that new evasion tactics may emerge. Regulatory agencies, enforcement agencies and exchanges may need to adapt their oversight and compliance programs accordingly.

Scammers, ransomware and crypto attacks

The underworld of cryptoassets has also featured at different points in the story. For example, and not surprisingly, criminals and scammers have attempted to take advantage of Ukraine's cryptoasset donation drive by setting up fake social media accounts and fundraising pages. Elliptic has identified several addresses publicised by scam or likely-scam social media channels and websites. They have found that most of them have not received any incoming transactions, with the remaining addresses receiving just under $100,000 in incoming cryptoasset value. Some fundraisers with red flags have received a further $240,000. Overall, these are small numbers and may be indicating an increase in the awareness of the crypto community.

Pro-Russian cybercriminals have several times tried to hack pro-Ukrainian wallets. Russian hacktivist groups have also emerged, targeting online services and essential functions of Ukraine and countries supporting Ukraine. Russian-speaking cybercrime has financed mercenary or military procurement groups, with over $250,000 of cryptoassets donated from dark web markets and stolen credit card data vendors. Pro-Russian separatists have used scam cryptoassets for fraudulent purposes, including Ponzi schemes.

This is likely to be due, at least in part, to direct state operations. One example of that could be the Conti ransomware group, known for targeting critical infrastructure, who supported the Russian government after the invasion of Ukraine. Leaked messages from Conti operatives revealed their relationship with Russian security services and post-ransom money laundering operations involving cross-chain transfers and exchanges.

Conclusions

The conflict between Russia and Ukraine has highlighted the role of cryptoassets in modern warfare. Pro-Ukrainian causes have raised over $212 million in cryptoassets, which accounts for one-fifth of the total non-state aid funds obtained and dwarfing pro-Russian entities which raised only $4.8 million.

Overall, the conflict has shown the potential use of cryptoassets in modern and asymmetric warfare, including financing the war and the humanitarian response, seeding militant groups, sanction avoidance, and ransomware and cryptoasset attacks.

Bibliography

European Commission, “Ukraine: EU agrees on eighth package of sanctions against Russia”

https://ec.europa.eu/commission/presscorner/detail/en/ip_22_5989

Elliptic: “Crypto in Conflict”, 2023

https://www.elliptic.co/resources/crypto-in-conflict

Chain Analysis, “A Year into Russia’s War on Ukraine, Cryptocurrencies Continue to Play a Key Role” 2023

https://blog.chainalysis.com/reports/russia-ukraine-war-cryptocurrency-one-year

Congressional research services, “Russian Sanctions and Cryptocurrency”, 4 May 2022

https://crsreports.congress.gov/product/pdf/IN/IN11920

Igor Makarov and Antoinette Schoar, “Blockchain Analysis of the Bitcoin Market”, NBER Working Paper No. 29396, October 2021

https://www.nber.org/system/files/working_papers/w29396/w29396.pdf

Scott Chipolina , “The two sides of crypto in Ukraine war”, Financial Times, 24 February 2023

https://www.ft.com/content/a3b59f3b-d0b3-4047-af71-c8ef61aa8d58

Footnotes

1 The law defines virtual assets as "digital assets in electronic form that can be an independent object of civil rights and have a material or intellectual nature." The law allows for the purchase, sale, and exchange of virtual assets in Ukraine, but also imposes certain requirements on individuals and companies dealing with virtual assets. For example, virtual asset service providers (VASPs) must register with Ukraine's financial regulator and comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. The law also imposes a tax on profits from virtual asset transactions, with rates depending on the duration of ownership and the amount of profit. Additionally, it prohibits the use of virtual assets for illegal activities, such as money laundering, terrorism financing, and the purchase of illegal goods and services.

2 The use of mixers, such as Tornado Cash, has been linked to sympathetic donors from Russia or pro-Russian areas who want to conceal their donation activities. Even Vitalik Buterin, the Russian-born founder of Ethereum, has admitted to using Tornado Cash to donate to Ukraine, despite the mixer being sanctioned by the United States in August 2022 due to concerns of money laundering. Buterin, who has publicly donated at least $5 million to pro-Ukraine causes, is not the only notable figure to use mixers for donations. Polkadot co-founder Gavin Wood donated $5.8 million, while Tron founder Justin Sun donated at least $200,000.

3 The Ministry of Digital Transformation collaborated with Everstake, FTX, and Kuna, and the funds were passed on to the National Bank of Ukraine after FTX's collapse.

4 NFT donations also took place on other blockchains, including Polygon, Solana, Cardano, and FTM.

5 The extent of illicit cryptoasset activity has indeed been subject to considerable debate, and different studies and assessments have yielded different estimates. However, it is generally agreed that the proportion of crime-linked addresses in the cryptoasset ecosystem has declined as the market has grown, even though the absolute number of such addresses may have increased. The recent study of Makarov and Schoar (2021) suggests that the percentage of illicit cryptoasset activity may be as low as 0.15%, which is much lower than earlier estimates

Haftungsausschluss