Does macro news affect cryptoassets?

Introduction

A small portion of the literature has investigated the return, volatility, and correlation of cryptoassets, and their responsiveness to macro conditions, delivering mixed results. This is an important question, because, on the one hand, the lack of correlation could be seen as an interesting property for the asset class, and on the other, most asset price models would imply a correlation with monetary and macro news.

A few notable works are:

1. Pyo and Lee (2020) investigate whether FOMC and macroeconomic announcements affect Bitcoin prices. They focus on the impact of selected macroeconomic announcements and use daily data and simple indicators of the events. They report a small pre-announcement effect on Bitcoin prices, while they find that the price change after the announcement is insignificant.

2. Corbet et al. (2020) analyses the impact of macro news on Bitcoin using daily data. They find that positive news in unemployment and durable goods announcements result in a decrease in Bitcoin returns, and vice versa. News relating to GDP and CPI are reported not to have a significant relationship with Bitcoin returns.

3. Gu et al (2021) find that, following the surprise announcements of QE, the two biggest cryptocurrencies, Bitcoin and Ethereum, have recorded significant abnormal returns.

4. Elsayed and Sousa (2022), analysed, with a time-varying spillovers connecting the major currencies and some key cryptoassets, Bitcoin, Litecoin and Ripple over the period August 2013 to September 2019. They find muted spillovers from monetary policy towards cryptoassets.

5. More recently, Benigno and Rosa have studied the problem with state-of-the-art techniques in a 2023 Federal Reserve Bank of New York Staff Report. Their main finding is that Bitcoin's price does not respond to most macroeconomic news considered, except for Consumer Price Index (CPI). This differs from traditional assets like gold, silver, S&P 500 and exchange rates, which exhibit significant responses to macroeconomic news.

Not surprisingly, results are somehow mixed. This Is due to the different methodologies used, but above all these studies are based on a short sample period, where trends of adoptions and changes in investors’ behaviours have shaped the market.

In this article we look at the results reported in the most recent and most advanced article, Benigno and Rosa (2023), and discuss their meaning. Let’s start with the model.

A simple model to understand crypto and macro news

A stylised asset price model for Bitcoin, as a rational stochastic bubble, would define its price as the weighted sum of two scenarios: one in which the asset has a positive price in the next period, bt+1, and the second in which its value goes to zero (in expectation). The second scenario could capture events during which the investors abandon the cryptoasset driving its price to zero. Both scenarios are discounted by the gross real interest rate, Rt, to obtain their current value in the asset pricing equation:

where the εt defines the random event in which the value of the asset is expected to be zero, i.e. Et [εt]=0, and the probability of the two scenarios are respectively qt and 1-qt.

This equation is not unique to Bitcoin but could be, for example, used to price gold, which has very limited intrinsic value. The probability, qt, that defines the two scenarios can be either exogenous to macro development or a function of the real rates. This would, for example, be the case when a high-rate scenario would convince investors to abandon the cryptoasset.

This “speculative asset” model for a cryptoasset has two different testable implications:

1. Monetary news should negatively affect the value of cryptoasset through an interest-rate channel. In other words, since its value negatively depends on Rt, and increase in the rates depresses the values of the cryptoasset. Moreover, monetary news about the future path of policy should have larger effects than those about the current target rate, due to the forward-looking nature of the asset.

2. Macroeconomic news can only affect the price of speculative assets indirectly if the central bank changes rates in response to macro conditions. Macro news would then affect the cryptoassets through the monetary policy reaction function, with positive inflation and real macroeconomic news having a negative impact, as long as monetary policy tightens in response to higher inflation and higher output.

As a comparison, the price of a stock can be seen as the expected present discounted value of its future dividends. An unexpected increase in US real economic activity can influence expectations of future dividends and future excess returns, but the response of stock prices depends on how central banks adjust the interest rates in reaction to the news. The dominant effect in practice is an empirical question.

The effects of news on exchange rate also depends on the reaction of monetary policy. For example, an unexpected increase in US inflation may lead to higher input costs for exports, potentially causing a nation's exports to become less competitive and its currency to depreciate. However, if the Federal Reserve responds to inflationary pressures by raising short-term interest rates, it could lead to an appreciation of the dollar.

Macro and monetary news

The empirical strategy of Benigno and Rosa (2023) to test the two hypotheses above involves examining the response of Bitcoin and other assets to different types of macro news. The examined macro news includes data releases related to the real economy, inflation, and forward-looking indicators over the period from 2017 to 2022.1

Monetary policy news is captured from federal funds future prices reactions, in windows of 30 minutes around Fed’s policy announcements. The price revisions at different maturities are disentangled into three distinct indicators capturing unanticipated changes to the short, medium, and long end of the yield curve. These three indicators can be related to the Fed’s surprise policy actions in terms, respectively, of the target policy rates, its forward path/forward guidance and QE.

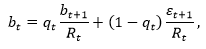

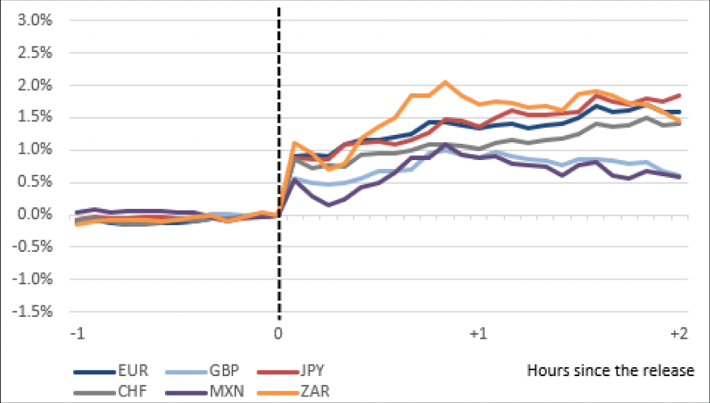

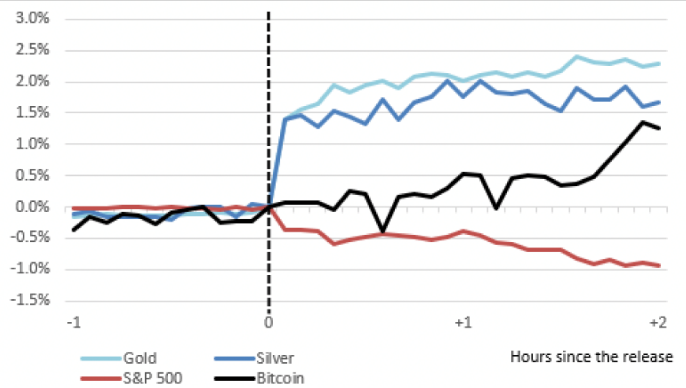

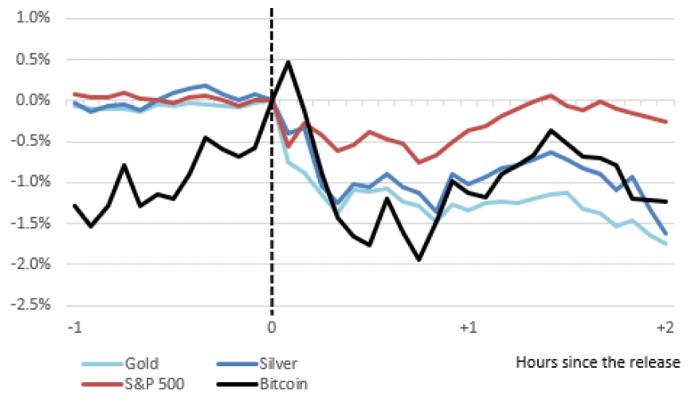

Figure 1 – Response to notable news

To get a sense of how the news affects assets and Bitcoin, we can look at Figure 1 that shows the impact of two types of news on various US asset prices. The top row displays the response around the release of news related to the real economy, specifically the labour market report in June 2016. The report indicated lower-than-expected nonfarm payrolls, leading to a depreciation of the dollar, a decline in stock prices, and an increase in the price of gold. However, Bitcoin did not show a significant response and remained relatively stable. The bottom row focuses on news related to monetary policy, specifically the June 2021 Federal Open Market Committee (FOMC) meeting. During this meeting, the FOMC signalled a need for interest rates to rise sooner and faster than anticipated by the market. As a result, the dollar, gold prices, and stock prices immediately responded to the news, but once again Bitcoin did not exhibit a notable reaction.

Bitcoin and other assets

To assess the response of Bitcoin to news, the paper runs various regression models to study the response over time of several assets to monetary and macro news.

Monetary news. The results indicate that news about the target rate and the path of future monetary policy have statistically significant effects on all asset prices. For example, a one percentage point surprise easing in the federal funds rate increases the S&P 500 equity index by 3.7% during the half-hour around the event. The coefficients for the Path and QE surprises are also negative and significantly different from zero. Regarding Bitcoin, the coefficients for the Target and QE surprises are negative but insignificant, while the coefficient for the Path surprise is negative and significant.

The response of Bitcoin to monetary news is a puzzle. One could expect that Bitcoin, as an asset with no intrinsic value, would respond to changes in current and future real interest rates, the analysis shows that Bitcoin does not exhibit a robust reaction to unexpected changes in the short-term rate or news about the future path of monetary policy.

Also, the results do not seem to show the pattern of larger effects for surprises at more distant horizons. The effects of Path and QE surprises should be expected to be larger than those of Target surprises. However, when normalising the effects by the standard deviation of the monetary surprise, the results show that a one standard deviation surprise in the Target and Path variables is associated with a roughly 0.6% change in Bitcoin, while the effect of QE surprises is close to zero.

Macro News. Most macroeconomic surprises, such as retail sales, nonfarm payrolls, trade balance, PPI, and CPI, have statistically significant effects on asset prices, including US dollar exchange rates, precious metal prices, and US stock prices. The estimated coefficients are negative, as expected. For instance, better-than-expected job growth is associated with an appreciation of the US dollar, while a lower-than-expected US trade balance is associated with a depreciation of the dollar. The magnitudes of these effects align with previous studies. The R-squared statistics are generally small, indicating that the surprise component of macro news explains only a small portion of asset price returns in the narrow 30-minute interval around the release. However, once again Bitcoin does not systematically respond to news about US macroeconomic fundamentals, with only CPI being significant at the 5% level.

Conclusions

While there may still be debate on how to model asset pricing for Bitcoin, several potential mechanisms would posit that macroeconomic news can affect the price of speculative assets, such as cryptoassets, possibly through a monetary policy reaction function channel.

To examine the financial market impact of major US macroeconomic news, Benigno and Rosa (2023) conduct a state-of-the-art study using macro news. The model estimates the response of asset prices to surprise macroeconomic and monetary announcements. The key results indicate that, different from other assets, Bitcoin do not respond to monetary or macro news.

It is however worth stressing that this analysis is based on a relatively short sample period, where trends of adoptions and changes in investors behaviour may be important, and which may limit the robustness of the conclusions.

Bibliography

Gianluca Benigno and Carlo Rosa, “The Bitcoin–Macro Disconnect,” Federal Reserve Bank of New York Staff Reports, no. 1052, February 2023

Cong Gu, Benfu Lv, Ying Liu, and Geng Peng, 2021. "The Impact of Quantitative Easing on Cryptocurrency," International Journal of Economics and Financial Issues, Econjournals, vol. 11(4), pages 27-34.

Erik Feyen, Yusaku Kawashima, Raunak Mittal, “The ascent of crypto-assets: evolution and macro-financial drivers”, April 2022

https://blogs.worldbank.org/developmenttalk/ascent-crypto-assets-evolution-and-macro-financial-drivers

Ahmed H. Elsayed & Ricardo M. Sousa (2022) International monetary policy and cryptocurrency markets: dynamic and spillover effects, The European Journal of Finance, DOI: 10.1080/1351847X.2022.2068375

Corbet, Shaen, Charles Larkin, Brian M. Lucey, Andrew Meegan, and Larisa Yarovaya, “The impact of macroeconomic news on Bitcoin returns,” The European Journal of Finance, 2020, 26, 1396–1416.

https://www.tandfonline.com/doi/abs/10.1080/1351847X.2020.1737168

Pyo, Sujin and Jaewook Lee, “Do FOMC and macroeconomic announcements affect Bitcoin prices?,” Finance Research Letters, 2020, 37, 101386.

Footnotes

1 Macroeconomic news are defined as the difference between the realized value of the macroeconomic data release on the day of the announcement and the financial markets’ expectation for that realized value. Different variables have different units of measurement. For this reason, to allow for a meaningful comparison each macroeconomic news event is standardised by dividing the surprise component of the announcement by its sample standard deviation.

Haftungsausschluss